does arkansas have an inheritance tax

And the credit for adoption expenses also 20 of the. The executor will also pay the creditors as their claims are received.

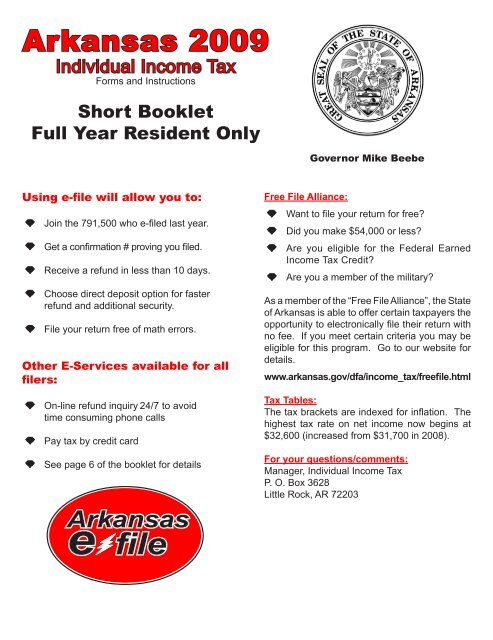

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed.

. The other option may allow withdrawal of your Notice of Federal Tax Lien if you have entered in or converted your regular installment agreement to a Direct Debit installment agreement. Total tax burden in Little Rock is about average 81 compared to the median rate for large US. You are a qualifying taxpayer ie.

The first 1250 in taxable income for individuals 2500 for joint filers is. Arkansas taxpayers have the 14th highest statelocal tax burden of any state. The law requires that with certain exceptions banking institutions and other.

CPA availability may be limited. Arkansas has a 69 income tax on a top bracket that starts at 35100. Tax Advice Expert Review and TurboTax Live.

The lien exists whether the tax is levied and assessed or not. 5435-19 New Jersey Transfer Inheritance Tax is a lien on all property owned by the decedent as of the date of their death for a period of 15 years unless the tax is paid before this or secured by bond. But Tennessee does have the Hall Tax which taxes dividends and some interest at 2 for 2019.

Individuals businesses with income tax liability only and out of business entities with any type of tax debt You owe. Although Arkansas does not have a personal exemption it does have a personal tax credit that reduces tax liability by 29 for each filer and each dependent. Other Arkansas credits include the political contribution credit of up to 50 per year.

Once all this work is done the executor will distribute the. They pay 3351 per capita in state and local taxes. The child care credit which is equal to 20 of the federal child care credit.

They may need to sell off some assets to have enough cash to pay the outstanding debts including medical bills and credit card bills. Marginal Income Tax Rates. Intuit will assign you a tax expert based on availability.

Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022.

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Arkansas Inheritance Laws What You Should Know Smartasset

Individual Income Tax Arkansas Department Of Finance And

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

Complete Guide To Probate In Arkansas

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Estate Tax Everything You Need To Know Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Arizona Real Estate

Pin On Apartments For Sale In Dhaka Dom Inno

Wills In The Uk Facts And Figures Infographic Uk Facts Facts Infographic

Title Insurance Is A Vital Form Of Indemnity Insurance Which Helps To Insure You Against Financial Loss Arising From Title Insurance Indemnity Insurance Title

Arkansas Estate Tax Everything You Need To Know Smartasset

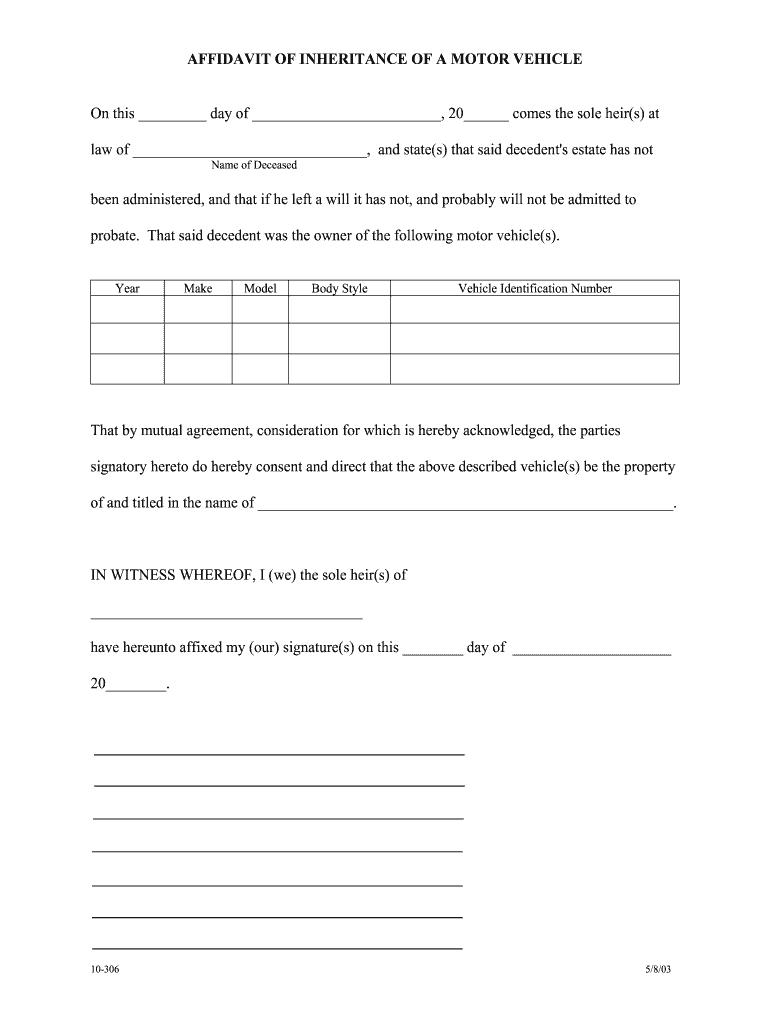

Affidavit Inheritance Form Fill Online Printable Fillable Blank Pdffiller

Arkansas Inheritance Laws What You Should Know Smartasset

Arkansas Retirement Tax Friendliness Smartasset

Is There An Inheritance Tax In Arkansas

Arkansas Retirement Tax Friendliness Smartasset

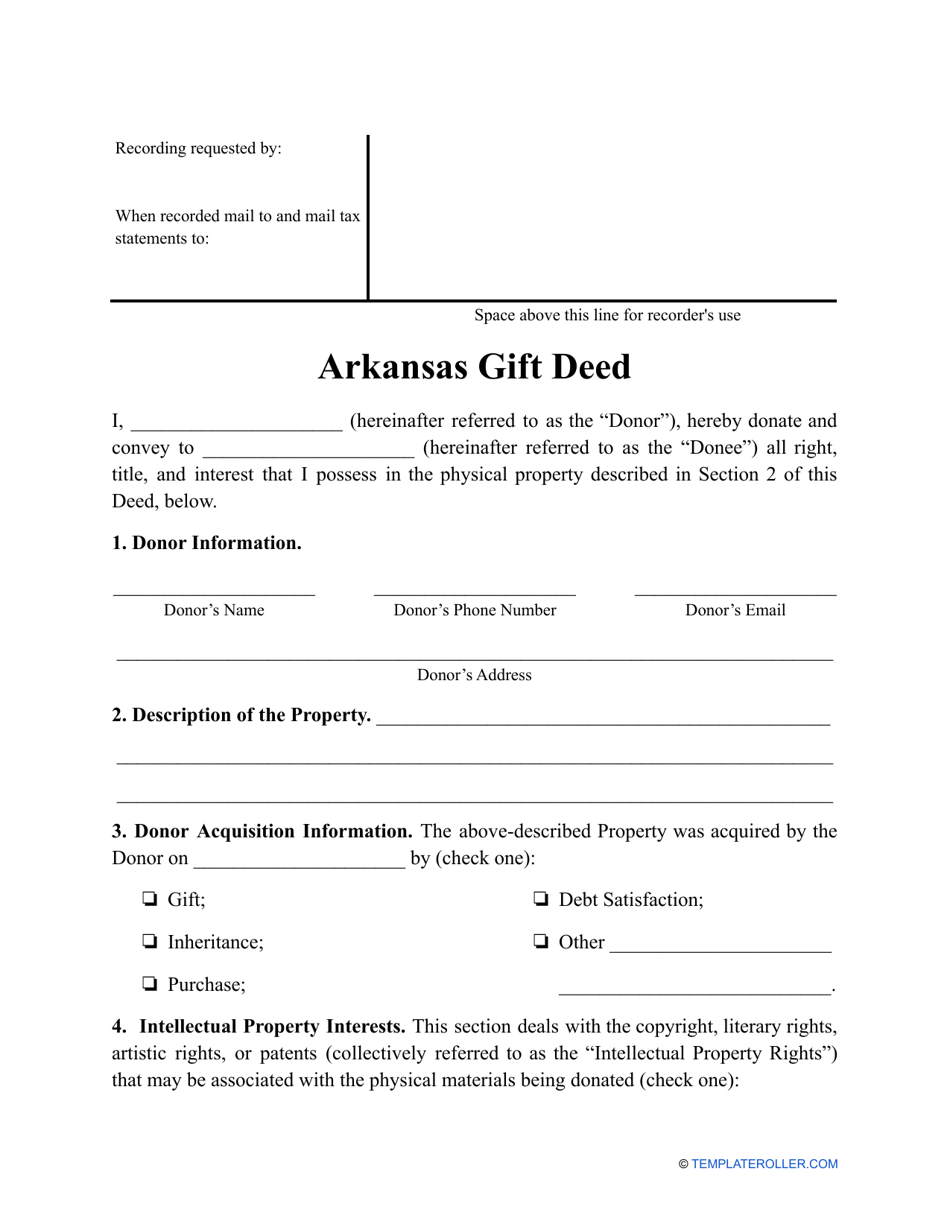

Arkansas Gift Deed Form Download Printable Pdf Templateroller