portability real estate taxes florida

The average savings for most homesteads in Hillsborough County is 250 300 depending on the millage rate. There are also special tax districts such as schools and water management districts that.

Residential Real Estate And Portability Filing Deadlines Extended Khani Auerbach Hollywood Fl Real Estate Lawyers

The assessed value will never be more than the just value of your.

. Apply for Portability when you apply for Homestead Exemption on your new property. Homestead portability allows the transfer of homestead assessment benefits from your previous homestead property to your new home. This is where the upper echelon of tax.

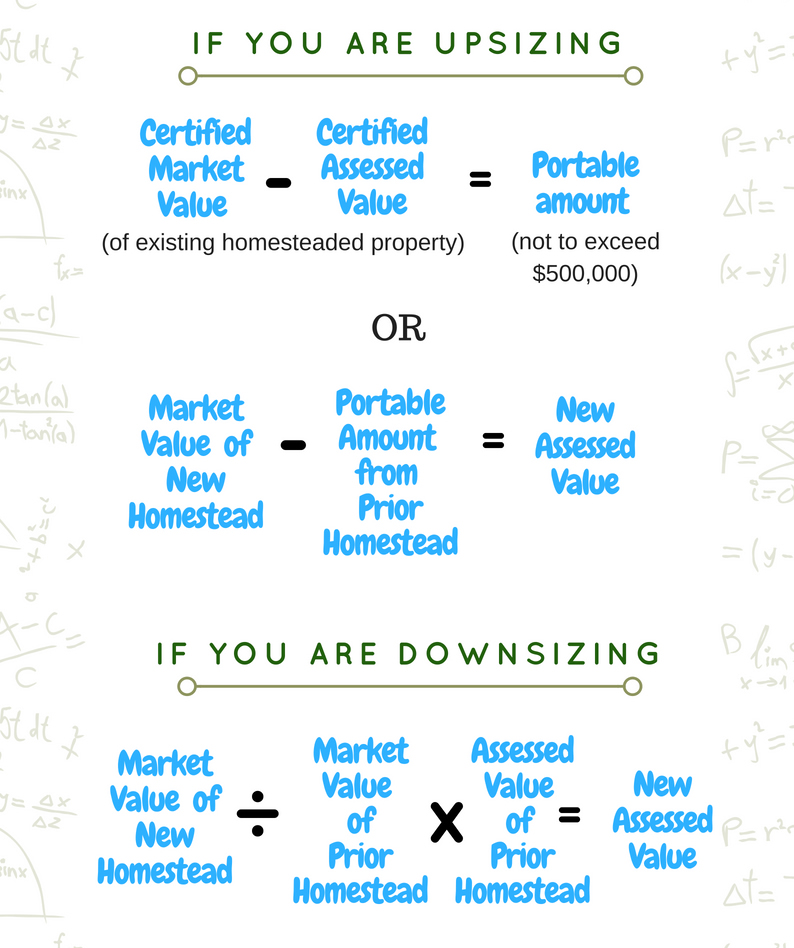

Previous Save Our Homes Difference DIVIDED by Previous Market. Florida Statutes Even if the value of your home decreases the assessed value may increase but only by this limited amount. 3 min read.

If you already own another property 2nd home beach house etc and establish your new homestead you can remove abandon the homestead from the old. 1 2008 and has become important given the decade-long runup in Florida property values. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer.

January 27 2022. If you moved to Hillsborough County from another Florida County provide the most complete address you can and be sure to. I a small standard annual deduction in the.

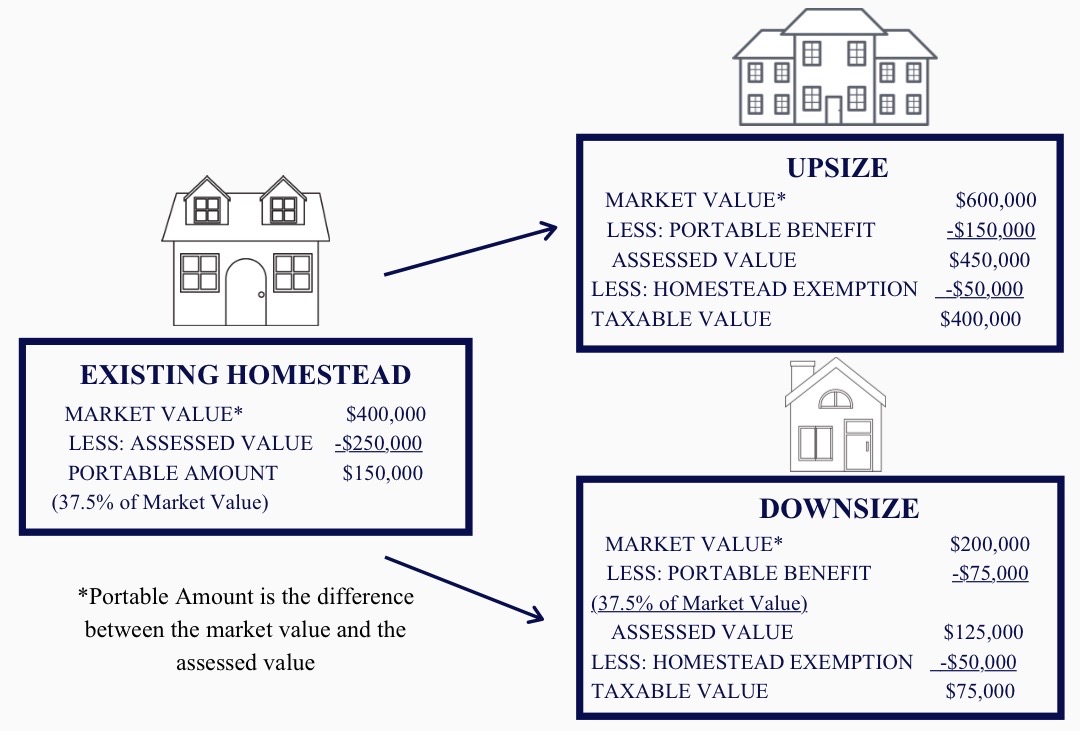

Will be applied to the assessed value of the new homesteaded property in the year that the portability. 100000250000 Cap Ratio 04. Wow what a day for Property Tax Portability and property owners in.

If you do not have property in Martin County enter 0 in both the Market Value and. Each county sets its own tax rate. Property Tax Portability Florida Election Results are In Real Estate a Big Winner.

Before portability came along some. The exemption will be automatically applied to your assessment for 2008. The average property tax rate in Florida is 083.

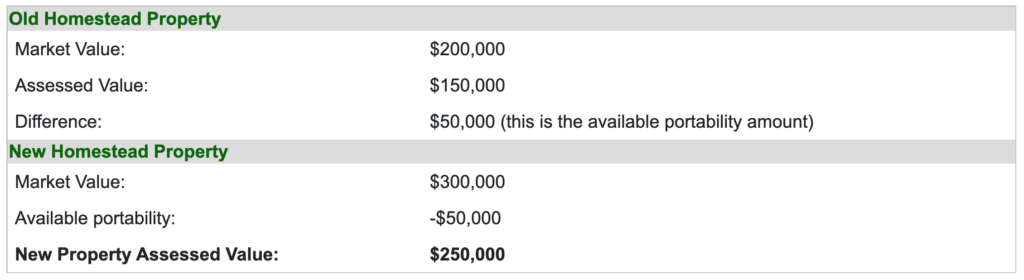

How does homestead portability work. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an. Video by Tommy Forcella 10252017.

The Heckerling Institute of Estate Planning in Orlando Florida is a sort of Superbowlin the world of Florida estate planning. On the Real Estate Tax Bill or use the parcel record search. Broward County Property Appraisers Office - Contact our office at 9543576830.

When buying real estate property do not assume property taxes will remain the same. Cap Ratio MULTIPLIED by New Market. We are open weekdays from 8 am until 5 pm.

When someone owns property and makes it his or her permanent residence or the permanent. By way of background the homestead tax benefit in Florida has two primary aspects which are. Previous Property selling or sold To find your current market value or assessed value click here for details.

Portability went into effect on Jan. If our office denies your portability application you will have an opportunity to file an appeal with Palm. Under Florida law e-mail.

Homestead Portability Saint Lucie County Property Appraiser

The Florida Homestead Exemption Explained Kin Insurance

Florida Property Taxes Florida Homestead Exemption Mangrove Title Legal Pllc

Homestead Portability What Is It And Should I Apply For It Us Patriot Title

Save Our Homes Portability Lower Your Property Taxes With Property Tax Professionals

Guide To The Homestead Tax Exemption For Central Florida Erica Diaz Team

Portability Of Florida S Save Our Homes Benefit

Indian River County Auditor Homestead Exemption

Bill Would Expand Property Tax Portability For Older Ca Homeowners

Guide To The Homestead Tax Exemption For Central Florida Erica Diaz Team

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida Homestead Portability Tips For The Emerald Coast 2021 Youtube

Florida And Miami Real Estate Homestead Exemption Portability And Property Tax Savings Benefits Q A Condoblackbook Blog

Fort Lauderdale Real Estate Tax Portability What The Heck Is That

Charlotte County Property Appraiser Exemptions

Property Tax Portability Jennifer Sego Llc

Hillsborough Property Appraiser Florida Portability Tax Laws The Tampa Real Estate Insider